The buzz around the Bharat Coking Coal IPO is steadily growing as investors look for the next strong PSU listing. With market participants closely watching the Bharat Coking Coal IPO GMP, questions around listing gains and short-term profits are becoming more relevant. Here is a clear and practical breakdown of the latest GMP trend and what it means for investors.

GMP UPDATE

Positive MomentumBharat Coking Coal IPO GMP

Updated:Latest grey market trend before listing

GMP reflects unofficial market sentiment and may change based on demand and subscription activity.

IPO Overview

Bharat Coking Coal Limited is a well-known public sector company and a key subsidiary of Coal India Limited. It is one of the largest producers of coking coal in India, supplying essential raw material to the steel and infrastructure sectors.

The IPO is expected to attract both retail and institutional investors due to the company’s strategic importance and government backing.

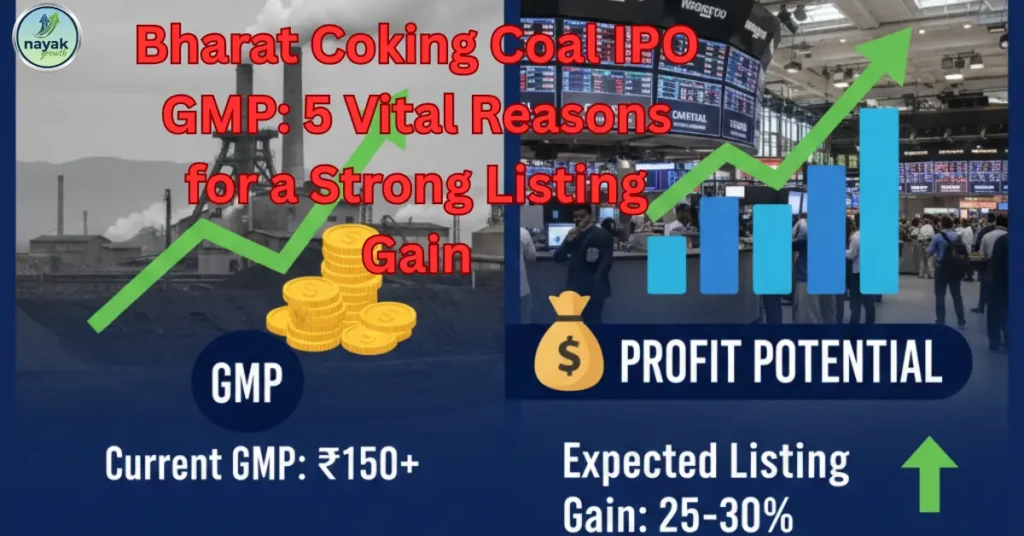

IPO GMP Today

The Bharat Coking Coal IPO GMP represents the unofficial premium at which IPO shares are traded in the grey market before listing. It acts as a sentiment indicator rather than a confirmed profit signal.

Current GMP trends suggest a moderate to positive outlook, indicating decent interest among investors. However, GMP levels may change rapidly based on subscription numbers, market volatility, and global cues.

Bharat Coking Coal IPO Details (Expected)

| Particulars | Details |

|---|---|

| Company Name | Bharat Coking Coal Limited |

| Sector | Mining / PSU |

| IPO Type | Mainboard IPO |

| Parent Company | Coal India Limited |

| Listing Exchange | NSE & BSE |

| Investor Interest | Moderate to High |

Note: Final figures may vary as official details are announced.

What Does IPO GMP Indicate?

A positive Bharat Coking Coal IPO GMP usually signals:

- Healthy demand in the unofficial market

- Positive listing expectations

- Confidence in short-term price performance

However, GMP is not regulated and should be treated as a reference point, not a guarantee.

Profit Chances Before Listing

Based on the latest Bharat Coking Coal IPO GMP update, profit chances before listing appear reasonable. Key drivers include:

- Strong PSU reputation

- Monopoly-like position in coking coal supply

- Long-term demand from the steel and infrastructure sectors

- Stable business model

Short-term investors may benefit if GMP remains stable or improves closer to listing day.

Key Risks to Keep in Mind

Every IPO carries risks. Important factors to consider include:

- Cyclical nature of the coal and steel industries

- Government policy and environmental regulations

- Global coal price fluctuations

- Overall market sentiment during listing

Ignoring these risks can impact returns, especially for short-term investors.

Should You Invest Based on GMP Alone?

The simple answer is no. The Bharat Coking Coal IPO GMP should be used as a supporting indicator, not the sole reason to invest.

- Listing gain seekers should track GMP and subscription data

- Long-term investors should focus on fundamentals and valuation

- Conservative investors should assess risk tolerance carefully

Balanced decision-making always works better than chasing hype.

Final Verdict

The Bharat Coking Coal IPO stands out due to its PSU status and sector relevance. The current Bharat Coking Coal IPO GMP suggests fair listing gain potential, provided market conditions remain favorable.

Combining GMP trends with company fundamentals and market analysis will enable investors to make more informed decisions.