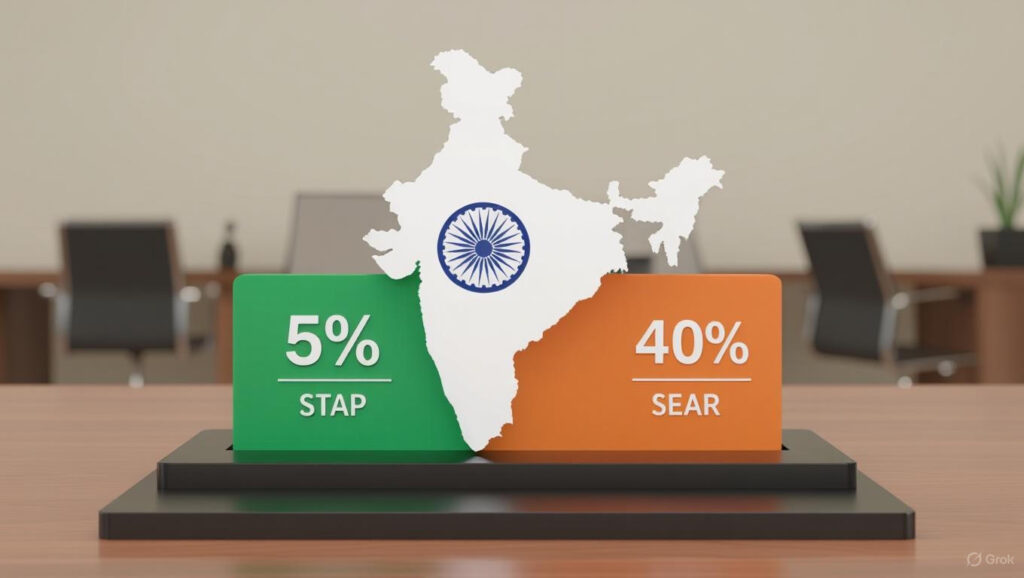

India will roll out GST 2.0 on September 22, 2025. The government scrapped the old four-slab system (5%, 12%, 18%, 28%) and replaced it with just two main slabs — 5% and 18%, along with a 40% sin tax on harmful and luxury goods. This move will reduce household bills, simplify compliance, and boost consumption ahead of the festive season.

GST 2.0 New Rates at a Glance

| Category | Old GST Rate | New GST Rate | Examples |

|---|---|---|---|

| Daily Essentials | 12% | 5% | Butter, ghee, cheese, dairy spreads |

| Personal Care | 18% | 5% | Shampoo, toothpaste, soaps, hair oil |

| Education Supplies | 5–12% | 0% (Exempt) | Notebooks, pencils, erasers |

| Insurance | 18% | 0% (Exempt) | Health insurance, life insurance |

| Small Cars & Bikes | 28% | 18% | Cars up to 1200 cc (petrol), bikes up to 350 cc |

| Electronics | 28% | 18% | ACs, TVs, dishwashers |

| Luxury & Sin Goods | 28% | 40% | Cigarettes, gutkha, pan masala |

Key Takeaways

- Essentials and groceries are now much cheaper.

- Toiletries and personal care products will see a big price drop.

- Cars, bikes, and electronics become more affordable.

- Insurance and school supplies are GST-free.

- Cigarettes, gutkha, and luxury goods will cost more than before.

Conclusion

GST 2.0 marks the biggest tax reform since 2017. By cutting the system down to two slabs, the government has made it simpler and more consumer-friendly. Essentials and household goods will become cheaper, cars and electronics more affordable, and insurance policies tax-free. At the same time, harmful and luxury goods will face higher taxes.

FAQs on GST 2.0

Q1. When will GST 2.0 start?

The new GST rates will start from September 22, 2025.

Q2. How many tax slabs does GST 2.0 have?

GST 2.0 uses two main slabs — 5% and 18%, plus a 40% slab for sin and luxury goods. Some essentials like milk and fresh vegetables remain tax-free.

Q3. Which items will get cheaper?

Toiletries, household items, butter, ghee, cheese, dairy spreads, small cars, motorcycles, air conditioners, dishwashers, and televisions will all get cheaper. Insurance and school supplies will become GST-free.

Q4. Which items will become costlier?

Cigarettes, gutkha, pan masala, and luxury goods will attract 40% GST, making them more expensive.

Q5. Will petrol and diesel come under GST 2.0?

No. Petrol and diesel remain outside GST, so their prices will not change.